As elaborated in (abstracts of) chapters 4 and 5 of my book by Elgar forthcoming in February 2021, comparing international arbitration in Australia and Japan in regional and global contexts, the case law in both countries applying UN instruments (then New York Convention and Model Law) has shared an internationalist pro-arbitration trajectory. This can be seen also through the secondary literature on international arbitration law published in Australia in recent years, listed on the Blog here through to end-2014 and published subsequently as listed at the end of this posting below (with thanks to CAPLUS intern James Tanna).

However, this shift has really only become more consistent in Australia over the last decade, as indicated also with Nobu Teramura et al here. The tardiness is partly due to residual more English approaches to arbitration law and dispute resolution generally. Another reason arises because Federal and diverse State/Territory courts share jurisdiction over International Arbitration Act (IAA) matters – making it slower and hard to move in a consistent direction.

A. IAA-related Case Disposition Times in the Federal Court of Australia

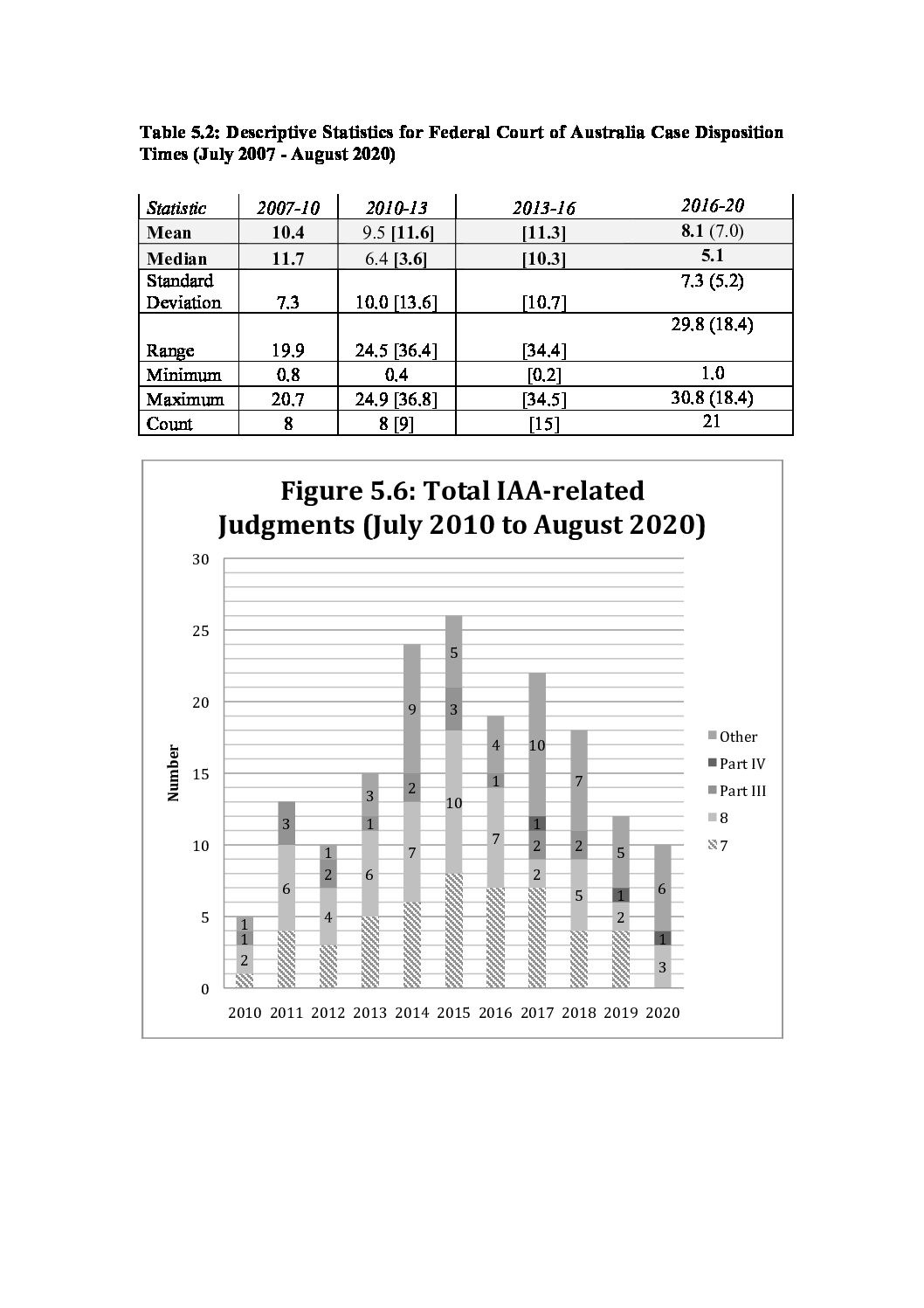

A related challenge for Australia is that even when the outcome rightly upholds an international arbitration agreement or award, IAA-related case disposition times in Australian courts seem to have remained quite lengthy. In 2013 and (with Diana Hu) in 2016 I published articles analysing timeframes taken by the Federal Court (arguably the most pro-arbitration over the last 15 years). Statistical analysis showed that they had not changed much in the three years before the 2010 IAA amendments that adopted almost all the 2006 revisions to the Model Law (now also being considered by Japanese law reformers).

For chapter 5 of the Elgar book, I added a statistical analysis for 21 significant IAA-related Federal Court of Australia cases (listed in this PDF) filed from August 2016 (WDR Delaware) and decided by July 2020 (although not counting Energy City Qatar, as the first-instance decision of 16 July 2020 to enforce the foreign award has been appealed). These 21 included two judgments that were not directly but still somewhat related to the IAA, and which largely cancel each other out for timeframes. One is another judgment in the Sino Dragon dispute, where Beach J decided quite quickly (1.6 months) and briefly not to follow eg Hong Kong and apply an “indemnity costs in principle” approach to failed challenges to awards. The second was a judgment in the Rinehart trust domestic arbitration under the Commercial Arbitration Act, but discussing also the IAA.

Overall, the average case disposition time was 8.1 months, with a median of 5.2 months, with these figures largely unchanged if we exclude both of the last-mentioned cases. If we then exclude an outlier (Sanum, 30.8 months to final judgment), the longest case disposition time becomes 18.4 months (Dalian Huarui), still with a median of 5.2 but standard deviation dropping from 7.3 to 5.2 months. Overall, these typical timeframes for the four years from mid-2016 do suggest some improvement compared to the three preceding three-year periods (see summary Table 5.2 here)

However, it remains disappointing that the numbers of cases being contested across all Australian courts have remained at quite high levels, rather than lawyers bringing fewer cases as might have been hoped under clearer and more pro-arbitration law through the 2010 (and 2015) amendments plus related case law. Figure 5.6 (here) charts a significant step up in litigation decided in the three calendar years after the 2010 amendments, and indeed a second step up over 2014-18, suggesting enduring formalisation around international arbitration in Australia. However, a significant proportion of judgments in 2017-8 made only passing reference to the IAA (thus being categorised “Other”), and total judgments rendered annually (especially non-Other) started to drop back from 2017. Nonetheless, the data analysis for 2020 only ran until end-August, and even if annual cases stabilise at around 2018-19 levels there will still have been a significant step-up compared to 2010.

It would also be interesting to compare case disposition times in non-federal courts in Australia, and in courts across Japan, as well as checking if Japanese judgments related to international cases under its Arbitration Act have increased much since its enactment in 2003. Unfortunately, it is much harder to obtain such data, and also to generalise from the Japanese case filings as not all judgments are reported (unlike in Australia including via Austlii).

B. Secondary Literature on International Arbitration in Australia since 2015

B.1 Books, chapters and journal articles

Evans, P. and G. Moens, eds (2015). Arbitration and Dispute Resolution in the Resources Sector An Australian Perspective. Cham, Springer International Publishing.

Holmes, M. and C. Brown (3rd ed 2018). The International Arbitration Act 1974: A Commentary, LexisNexis.

Lewis, D. (2016). Interpretation and Uniformity of the UNCITRAL Model Law on International Commercial Arbitration: Australia, Hong Kong and Singapore. Kluwer

Nottage, L. (2021). International Commercial and Investor-State Arbitration: Australia and Japan in Regional and Global Contexts Cheltenham, Edward Elgar.

* * *

Allsop, J. (2018). Commercial and Investor-State Arbitration: The Importance of Recognising Their Differences. ICCA Congress 2018. Sydney.

Carroll, L. and F. Williams. (2019). “Australia: Investor-State Arbitration Laws and Regulations 2020.” from https://iclg.com/practice-areas/investor-state-arbitration-laws-and-regulations/australia.

Dickson-Smith, K. D. and B. Mercurio (2018). “Australia’s Position on Investor-State Dispute Settlement: Fruit of a Poisonous Tree or a Few Rotten Apples?” Sydney Law Review 40(2): 213.

Garnett, R. (2017). “Arbitration of Cross-Border Consumer Transactions in Australia: A Way Forward?” Sydney Law Review 39(4): 569-599.

Holmes, M., L. Nottage and R. Tang (2016). “The 2016 Rules of the Australian Centre for International Commercial Arbitration: Towards Further Cultural Reform.” Asian International Arbitration Journal 12(2): 211-234.

Kawharu, A. and L. Nottage (2018). “Renouncing Investor-State Dispute Settlement in Australia, Then New Zealand: Déjà Vu.” Sydney Law School Research Paper 18/03.

Kawharu, A. and L. Nottage (2018). “The Curious Case of ISDS Arbitration Involving Australia and New Zealand.” University of Western Australia Law Review 44(1 2): 70.

Kawharu, A. and L. Nottage (2018). Foreign Investment Regulation and Treaty Practice in New Zealand and Australia: Getting it Together in the Asia-Pacific? International Investment Treaties and Arbitration Across Asia. L. Nottage and J. Chaisse, Brill | Nijhoff: 443–485.

Kawharu, A. and L. Nottage (2019). Towards an Asia-Pacific Regional Investment Regime: The Potential Influence of Australia and New Zealand as a Collective Middle Power. J. Chaisse. Cambridge, Cambridge University Press.

Kurtz, J. and L. Nottage (2015). “Investment Treaty Arbitration ‘Down Under’: Policy and Politics in Australia.” ICSID Review – Foreign Investment Law Journal 30(2): 465-480.

Linderfalk, U. (2017). “Philip Morris Asia Ltd. v. Australia – Abuse of Rights in Investor-State Arbitration.” Nordic journal of international law = Acta scandinavica juris gentium 86(3): 403-419.

Luttrell, S. and I. Devendra (2015). “Inherent jurisdiction and implied power to stay proceedings in aid of arbitration: ‘A nice question’.” Journal of International Arbitration 32(5): 509.

Luttrell, S., C. Hassall, V. Lemaic and M. d. Marco. (2020). “International Arbitration 2020: Australia.” from https://practiceguides.chambers.com/practice-guides/international-arbitration-2020/australia.

Monichino, A. (2015). “The future of international arbitration in Australia.” Victoria University Law and Justice Journal 5(1): 60-74.

Monichino, A. (2016). “Arbitration Downunder – Two Steps Forward, One Step Back; Samsung C&T Corporation v Duro Felbuera Australia Pty Ltd [2016] WASC 193”. Australian Construction Law Newsletter 169: 28-31.

Monichino, A. (2016). “Privilege Disputes in International Arbitration.” The ACICA Review 4(2): 46-49.

Monichino, A. and A. Fawke (2014). “Enforcement of Foreign Arbitral Awards, Issue Estoppel and Comity: Developments in Australia”. Asian Dispute Review 16(1): 10-14.

Monichino, A. and A. Fawke (2014). “International arbitration in Australia: 2013/2014 in review.” Australasian Dispute Resolution Journal 25.

Monichino, A. and A. Fawke (2015). “International arbitration in Australia: 2014/2015 in review.” Australasian Dispute Resolution Journal 26.

Monichino, A. and A. Fawke (2016). “International arbitration in Australia: 2015/2016 in review.” Australasian Dispute Resolution Journal 27.

Monichino, A. and A. Fawke (2018). “International Arbitration in Australia: 2016/2017 In Review.” Australasian Dispute Resolution Journal 28.

Monichino, A. and A. Fawke (2019). “International Arbitration in Australia: 2017/2018 in Review.” Australasian Dispute Resolution Journal 29.

Monichino, A. and L. Nottage (2018). “Australia Country Update.” Asian Dispute Review (July 2018).

Monichino, A. and N. Teramura (2020). New Frontiers for International Commercial Arbitration in Australia: Beyond the ‘Lucky Country’. New Frontiers in Asia-Pacific International Arbitration and Dispute Resolution. L. Nottage, S. Ali, B. Jetin and N. Teramura, Wolters Kluwer.

Morrison, J. (2019). “Recent Developments in International Arbitration in Australia 2017-2018.” Journal of International Arbitration 36(3): 416.

Morrison, J. and M. Flanagan (2016). “Recent Developments in International Arbitration in Australia 2015/2016.” Journal of International Arbitration 33(6): 723-737.

Nottage, L. (2014). “Investor-State Arbitration: Not in the Australia-Japan Free Trade Agreement, and Not Ever for Australia?” Journal of Japanese Law 38: 37-52.

Nottage, L. (2015). “Do Many of Australia’s Bilateral Treaties Really Not Provide Full Advance Consent to Investor-State Arbitration? Analysis and Regional Implications.” Transnational Dispute Management 12: 1-18.

Nottage, L. (2015). “Investment Treaty Arbitration Policy in Australia, New Zealand and Korea.” Journal of Arbitration Studies 25(3): 185-223.

Nottage, L. (2015). “The Evolution of Foreign Investment Regulation, Treaties and Investor-State Arbitration in Australia.” New Zealand Business Law Quarterly 21: 266-276.

Nottage, L. (2016). “The TPP investment chapter and investor-state arbitration in Asia and Oceania: assessing prospects for ratification.(Trans-Pacific Partnership Agreement, 2015)(The Age of Mega-Regionals: TPP & Regulatory Autonomy in International Economic Law).” Melbourne Journal of International Law 17(2): 313.

Nottage, L. (2017). Investor-State Arbitration Policy and Practice in Australia. Second thoughts : investor-state arbitration between developed democracies. A. de Mestral. Ontario, Canada, Centre for International Governance Innovation: 377-430 (also in 2016: CIGI Investor-State Arbitration Series Paper 6: http://ssrn.com/abstract=2685941)

Nottage, L. (2020). “Confidentiality and Transparency in International Arbitration: Asia-Pacific Tensions and Expectations.” Asian International Arbitration Journal 16(1): 1-23.

Nottage, L. and A. Ubilava (2018). “Costs, Outcomes and Transparency in ISDS Arbitrations: Evidence for an Investment Treaty Parliamentary Inquiry.” International Arbitration Law Review 21(4): 111-117.

Nottage, L. and J. Hepburn (2018). Investment Treaty Arbitration Claims Over Tobacco Plain Packaging: Running Out of Puff? Hochelaga Lectures 2017. A. Reyes. Hong Kong, Hong Kong University Faculty of Law.

Nottage, L. and J. Morrison (2017). “Accessing and Assessing Australia’s International Arbitration Act.” Journal of International Arbitration 34(6): 1-43.

Nottage, L. and R. Garnett (2019). The Australian Centre for International Commercial Arbitration. Max Planck Encyclopedia of International Procedural Law H. R. Fabri, Oxford University Press.

Shankar, T. (2016). “Natural justice in international commercial arbitration: TCL air conditioner (Zhongshan) Co Ltd v Castel electronics Pty Ltd.” University of Western Australia Law Review 40(2): [113]-122.

Teramura, N., L. Nottage and J. Morrison (2020). Judicial Control of Arbitral Awards in Australia. The Cambridge Handbook of Judicial Control of Arbitral Awards. L. A. DiMatteo, M. Infantino and N. M.-P. Potin, Cambridge University Press: 175-197.

Trakman, L. (2018). The Reform of Commercial Arbitration in Australia: Recent and Prospective Developments The developing world of arbitration: a comparative study of arbitration reform in the Asia Pacific. A. Reyes and W. Gu. Oxford [UK], Hart Publishing: 251-278.

Trakman, L. E. and D. Musayelyan (2016). The Repudiation of Investor–State Arbitration and Subsequent Treaty Practice: The Resurgence of Qualified Investor–State Arbitration, Oxford University Press. 31: 194-218.

Ubilava, A. and L. Nottage (2020). Novel and Noteworthy Aspects of Australia’s Recent Investment Agreements and ISDS Policy: The CPTPP, Hong Kong, Indonesia and Mauritius Transparency Treaties. New Frontiers in Asia-Pacific International Arbitration and Dispute Resolution. L. Nottage, S. Ali, B. Jetin and N. Teramura, Wolters Kluwer.

B.2 ACICA Review and other shorter articles

Bernard, C. M. and J. Morrison (2018). “Amendments to the International Arbitration Act 1974 (Cth).” The ACICA Review 6(2): 9-10.

Bonnell, M., D. Mallett, R. Gao and K. Tam (2016). “Philip Morris v Australia: lessons for structuring investments.” The ACICA Review 4(1): 20-21.

Brimfield, F. (2016). “Gutnick v Indian Farmers Fertiliser Cooperative Ltd: Another strong example of Australian Court’s pro-enforcement attitude.” The ACICA Review 4(1): 26-28.

Chung, L. and P. Winch (2016). “Indemnity costs and the enforcement of arbitral awards in Australia.” The ACICA Review 4(2): 16-17.

Dearness, M. and L. Chung (2018). “Case Note: Duro Felguera Australia Pty Ltd v Trans Global Projects Pty Ltd (in liquidation).” The ACICA Review 6(2): 11-13.

Dearness, M., L. Chung and P. Winch (2018). “Case Note: Trans Global Projects v Duro Felguera Australia ” The ACICA Review 6(1): 11-13.

Delaney, J. (2018). “A race to set aside or enforce the award: Hyundai Engineering & Steel Industries Co Ltd v Alfasi Steel Constructions (NSW) Pty Ltd.” The ACICA Review 6(2): 25-27.

Gleeson, M. (2015). “Evidence in international commercial arbitration: Some issues.” Victorian Bar News(158): 40-45.

Govey, I. (2018). “Australia’s Framework for International Commercial Arbitration.” The ACICA Review 6(2): 21-24.

Horrigan, B., I. Bacvic and P. Holloway (2017). “Federal Court Sets Aside International Arbitration Awards and Removes an Arbitrator.” The ACICA Review 5(2): 19-20.

Jones, D. (2019). “Arbitration in Australia – Rising to the Challenge.” The ACICA Review 7(2): 28-36.

Karantonis, J. (2015). “The 3rd Annual International Arbitration Conference in Sydney.” The ACICA Review 3(2): 43-45.

Monichino, A. (2016). “Privilege Disputes in International Arbitration.” The ACICA Review 4(2): 46-49.

Monichino, A. (2017). “Enforcement of Arbitration Agreements Against Non-Signatories: Which Law (the Chicken and the Egg)?” The ACICA Review 5(2): 43-46.

Monichino, A. (2019). “Application of Arbitration Agreements to Non-Signatories: The ‘Through or Under’ Route.” The ACICA Review 7(2): 47-50.

Monichino, A. and M. Carroll (2019), “The Proper Approach to the Interpretation of Arbitration Agreements: Australian High Court Speaks Out”. The ACICA Review 7(1): 8-15.

Nottage, L. (2017). “Book review: Dean Lewis, ‘The Interpretation and Uniformity of the UNCITRAL Model Law on International Commercial Arbitration: Focusing on Australia, Hong Kong and Singapore’ ” The ACICA Review 5(1): 48-51.

Paton, A. and L. Nottage (2019). “Confidentiality versus Transparency in International Commercial and Investment Treaty Arbitration in Australia, Japan and Beyond.” The ACICA Review 7(2): 54-56.

Quan-Sing, J. and L. Hands (2016). “Samsung C&T Corporation v Duro Felbuera Australia Pty Ltd [2016] WASC 193.” The ACICA Review 4(2): 20-23.

Sladojevic, A. (2015). “The International Arbitration Act 1974 – summarising recent legislative amendments.” The ACICA Review 3(2): 39-40.

Teramura, N. (2018). “Australian Perspectives on International Commercial Dispute Resolution for the 21st Century: A Symposium.” The ACICA Review 6(1): 36-38.

Thompson, S. (2016). “Federal Court of Australia imposes substantial costs order as a deterrent to those requesting that it set aside or intervene in Australian International Arbitral Award.” The ACICA Review 4(2): 18-19.

Ubilava, A. (2017). “International Investment Arbitration Across Asia: A Symposium.” The ACICA Review 5(1): 45-47.

Wakefield, J. and K. Narkiewicz (2015). “Australia’s new arbitration regime: five years on.” LSJ: Law Society of NSW Journal(8): 72.